As a metric, burn rate stands out for its simplicity yet crucial role in the startup ecosystem. It has become a language spoken not only by investors but also by startup enthusiasts, fostering pivotal discussions around what constitutes a typical startup burn rate, the factors influencing it, and strategies to maintain control.

The concept of “burn rate” has become a cornerstone in the vocabulary of the startup and business community. Its roots delve into the dynamic world of startups, notably spotlighted in Michael Wolff’s book, “Burn Rate: How I Survived the Gold Rush Years on the Internet.” Within the pages of this insightful book, Wolff shares his firsthand experiences from the frenzied era of the dot-com boom, shedding light on the intricate dance of managing cash flow in the face of challenges.

In the entrepreneurship ever – evolving world, conversations revolving around burn rate have become indispensable. Let’s explore its significance and unveil strategies for sustainable financial growth in the startup world.

As per general understanding revenue growth is a measure that quantifies the increase in a company’s total income over a specific period. It is often expressed as a percentage and is indicative of a company’s ability to generate more revenue compared to previous periods. Positive revenue growth is generally considered a positive sign, reflecting the company’s ability to expand its market share, increase sales, or enhance pricing strategies. Conversely, stagnant, or negative revenue growth may indicate challenges in the business, such as market saturation, ineffective marketing, or operational inefficiencies. Monitoring revenue growth is crucial for assessing the overall health and sustainability of a business.

The essence of revenue growth holds a central place in business literature. Renowned authors, exemplified by Philip Kotler in his masterpiece “Principles of Marketing,” underscore the pivotal role of revenue growth as a fundamental metric for gauging a company’s market prowess. Further amplifying this perspective, financial luminaries like Warren Buffett consistently highlight the critical importance of sustained revenue growth when appraising the enduring viability of an investment.

The cash burn rate is a crucial metric, often calculated in months, to determine how long a company can sustain its current spending. The focus is typically on a quarterly (3 months) calculation. The formula for the cash burn rate is vital for small business owners actively seeking funding.

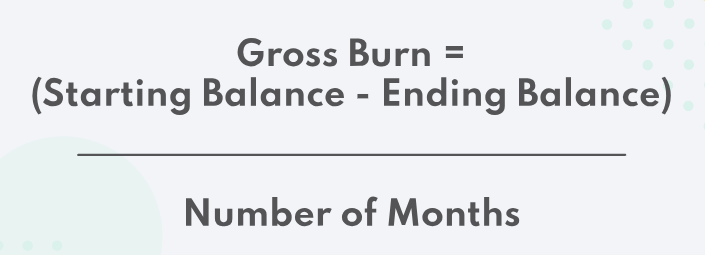

Gross Burn Rate:

There are two types of cash burn rate formulas: gross and net. Gross burn, relevant for those seeking funding, measures total cash burn on operating expenses alone-payroll, rent, utilities, taxes, etc. In early growth stages, net burn includes revenue, but it may not be consistent.

Calculation of Gross Cash Burn Rate:

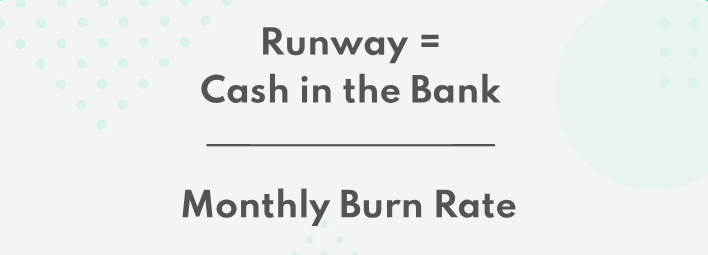

Measuring burn rate involves determining cash runway-the company’s life expectancy at current spending. Striking a balance is crucial in funding rounds. Underfunding risks a short runway, while excess funding wastes resources and equity. A common practice is raising funds to last 18 months-allowing a year for profit generation and a 5+ month cash runway for investor engagement.

7 Key Strategies for Accountants and Startups!

Cut Costs: Analyze your spending meticulously to uncover potential areas for optimization. In a recent study, 75% of successful startups attributed their initial financial stability to effective cost-cutting measures. Negotiating rates and eliminating unnecessary expenses can significantly impact your bottom line.

Automation: Embrace the power of automation for streamlined operations. According to a survey by McKinsey, businesses that automated repetitive tasks witnessed a 20% increase in productivity. Automating invoicing, payroll, and inventory management can free up valuable time for strategic initiatives.

Outsourcing: Optimize your workforce by leveraging contract labor. Research shows that startups outsourcing non-core functions can achieve up to 60% cost savings. By strategically outsourcing tasks, you can focus on core competencies, driving efficiency and cost-effectiveness.

Review Revenue Streams: Validate your product-market fit to ensure sustainable growth. Startups that conduct market research during their early stages are 30% more likely to succeed. Analyze customer feedback and adapt your revenue model to align with market demands.

Reduce Business Credit Lines: Maintain control over your expenses by carefully managing business credit lines. A study by Dun & Bradstreet found that businesses with controlled credit lines had a 25% lower risk of financial distress. Limiting the use of credit cards provides better control over spending and interest rates.

Cash Forecasting: Plan for significant expenses with cash forecasting ahead of the yearend. Businesses that adopt cash forecasting experience a 15% improvement in financial decision-making. This strategy ensures you have the financial runway to navigate challenges and seize opportunities.

Seek More Funding: Initiate investor negotiations early on to secure the necessary funds. Research indicates that startups that engage with investors in their first year are 50% more likely to secure additional funding. Building a rapport with investors sets the stage for sustainable growth and long-term success.

A holistic approach to these strategies, grounded in accurate financial data, sets the stage for success. Startups that integrate data-driven decision-making into their financial planning are 20% more likely to achieve their long-term objectives.

A guide to Controlling higher Burn Rate:

Founders and investors gauge burn rates against forecasts to predict company life expectancy. Tools and strategies are essential to maintain control and longevity.

Step 1: Know Your Development Stage

Step 2: Validate Product and Client Base

Step 3: Optimize Cash Flow Management

Step 4: Versatility in Roles

The “Accounting Way”: Accruals accounting offers options for deferred expenses, startup costs, and reporting burn rates. Timing is key – consider quarterly or yearly reporting.

Minimize Burn:

Operating Cash Flows: Flexibility in hiring and contract structures.

Investing Cash Flows: Opt for renting over purchasing.

Financing Cash Flows: Examine expenses impacting cash flow.

Stay ahead, control your burn, and pave the way for sustainable growth!

The cash burn rate is a crucial metric, often calculated in months, to determine how long a company can sustain its current spending. The focus is typically on a quarterly (3 months) calculation. The formula for the cash burn rate is vital for small business owners actively seeking funding.

Gross Burn Rate:

There are two types of cash burn rate formulas: gross and net. Gross burn, relevant for those seeking funding, measures total cash burn on operating expenses alone-payroll, rent, utilities, taxes, etc. In early growth stages, net burn includes revenue, but it may not be consistent.

Comparing Burn Rate and Revenue growth:

Revenue growth and burn rate stand as pivotal metrics for accountants and startups alike. Revenue growth acts as the engine propelling startups forward, ensuring financial stability and attracting investors. Accountants play a crucial role in deciphering growth trends and guiding strategic decisions based on revenue data. On the flip side, burn rate measures how quickly a company consumes cash-a vital metric to prevent financial distress. While burn rate necessitates cost management, revenue growth fuels financial health. For accountants, aligning revenue growth with burn rate analysis creates a powerful synergy. It allows precise resource allocation, strategic decision-making, and instills investor confidence. Together, revenue growth and burn rate become potent tools for accountants and startups, steering them towards sustained success.